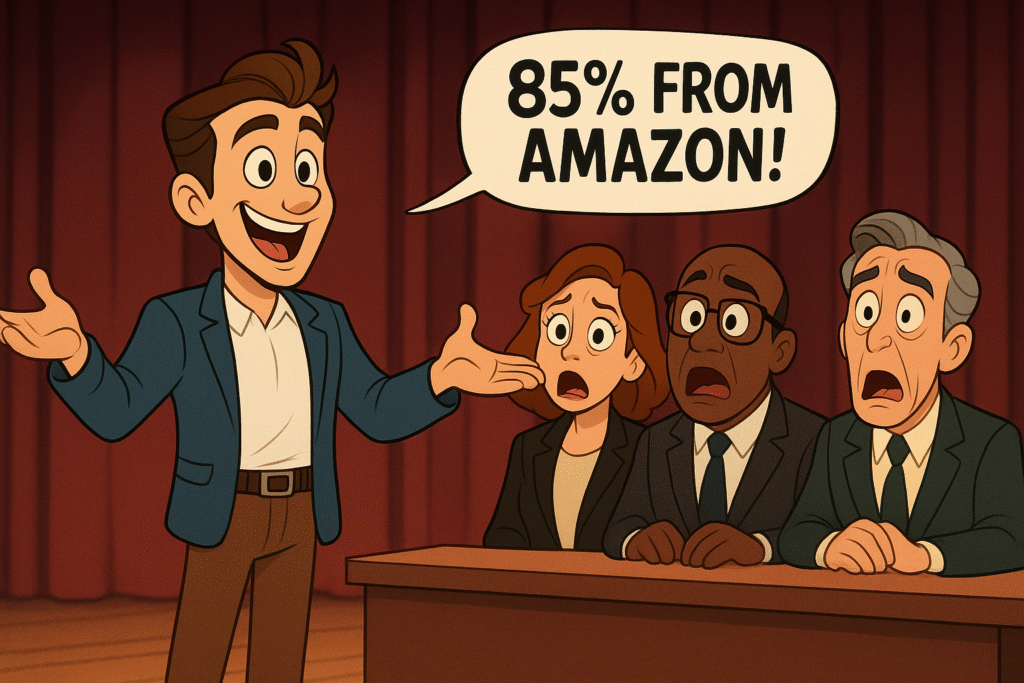

There’s a collective intake of breath when Shark Tank contestants proclaim that over 80% of their sales come from Amazon.

It’s not the good kind of gasp.

The sharks recognize what many entrepreneurs miss: Amazon-centric businesses are built on rented land owned by a landlord who doesn’t prioritize your success.

Things have changed since Amazon’s early marketplace days. Amazon-dependent businesses can generate real revenue, yet they face structural challenges that traditional retail never imposed.

First, Amazon owns your customers, not you. Every transaction happens within THEIR walled garden, using THEIR customer data, through THEIR relationship.

You’re a product supplier, not a brand builder. When customers think “I need to reorder that thing,” they go to Amazon, not to you.

Second, Amazon makes money on their advertising platform whether you profit or not. They double-dip by collecting revenue on the products you pay them to promote.

Most businesses selling on Amazon wouldn’t be profitable without those ads, creating a dependency that tightens over time.

Third, algorithm vulnerability creates existential risk. If your product runs out of stock, gets unfavorable reviews, or faces increased competition, Amazon’s algorithm can essentially make you invisible overnight.

Competitors or copycats can win your placement, leaving you scrambling to regain visibility you never actually controlled.

Meanwhile, Amazon’s cost-per-click advertising continues rising as more sellers compete in the auction for the same customer attention, squeezing everyone’s margins further each quarter.

Very few true direct-to-consumer brands have grown from Amazon-first strategies.

The platform’s structure actively prevents the customer relationship building that creates sustainable brands.

In I Need That, I discuss how the strongest products create direct relationships with customers who become genuine advocates. Amazon’s model optimizes for transaction efficiency and velocity, not emotional connection with the product brand.

Product Payoff: Shoe unicorn Allbirds deliberately avoided Amazon for their first five years, focusing on direct-to-consumer sales and carefully selected retail partnerships. This strategy allowed them to build genuine brand loyalty, control their customer experience, and develop direct relationships with buyers who became advocates.

When Allbirds finally launched on Amazon in 2020, it was from a position of strength — using the platform for distribution while maintaining their primary customer relationships through owned channels.

Action for today: If you’re selling on Amazon, calculate your true profitability after advertising costs, fees, and customer acquisition expenses. Then assess what percentage of your growth comes from repeat Amazon customers versus new customer acquisition.

Create a strategy for building direct relationships with your best Amazon customers through packaging inserts, follow-up communications, or exclusive offers that drive them to owned channels.

Use Amazon for what it does well — distribution — while building REAL customer relationships elsewhere.

This doesn’t mean avoiding Amazon and similar platforms entirely. But understand the trade-offs and build a strategy that uses these channels without becoming trapped by them.

How has your experience with Amazon or similar platforms shaped your customer relationship strategy?

Tap that reply arrow (owned by someone who isn’t me) and share whether you’ve found ways to build genuine customer connections within marketplace constraints.

Or reach out to my team of product strategy specialists at Graphos Product.