What’s your exit strategy?

If that makes you squirm a bit, you’re far from alone.

Many product makers pour everything they’ve got into the day-to-day, without lifting their gaze to the horizon. But last week’s news about Skechers provides a timely reminder to reflect on your own endgame.

After 25 years as a public company, Skechers is going private — acquired by global investment powerhouse 3G Capital.

The footwear giant will vanish from the New York Stock Exchange while continuing its strategic initiatives, including direct-to-consumer expansion and investments in infrastructure.

Timing is everything.

With a costly trade war driving up prices across global supply chains, it’s a time for strategic action.

And pivots. Just weeks ago, Skechers withdrew its full-year 2025 guidance “due to macroeconomic uncertainty stemming from global trade policies.”

They weren’t acting alone — 76 footwear brands including Nike, Adidas, and Under Armour pleaded for tariff exemptions through their industry association.

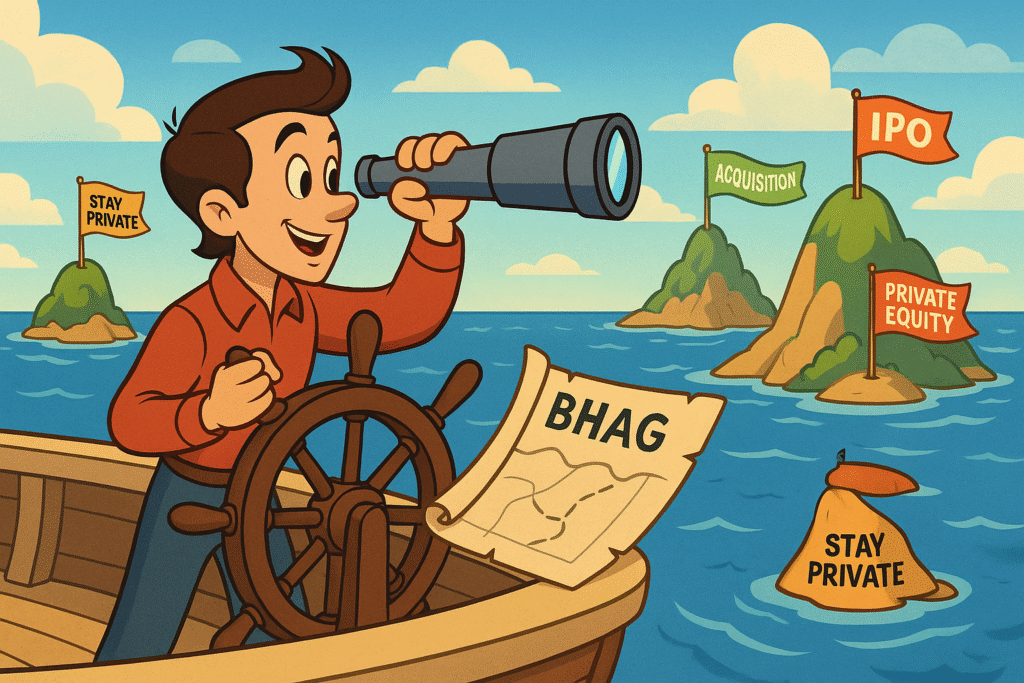

This moment raises a huge question for every product business: What’s your BHAG — your Big Hairy Audacious Goal?

In I Need That, I get into how products with clarity of purpose outperform those simply reacting to market conditions.

Your endgame shapes every strategic decision along the way.

Look at some of the divergent paths:

- IPO: The traditional brass ring, bringing capital and prestige, but also quarterly pressure and regulatory burden

- Acquisition: Faster liquidity but potential loss of control and vision

- Private equity: Capital infusion while maintaining some operational independence

- Sustained private growth: Maintaining control but potentially limiting scale

So … which path aligns best with YOUR product vision?

Product Payoff: Sara Blakely, founder of Spanx, held onto 100% ownership for 21 years before selling a majority stake to Blackstone in 2021. This very patient approach allowed her to build on her own terms, without rushed growth or compromised quality.

When Blakely finally took on investment at a $1.2 billion valuation, she did so from a position of strength, selecting partners who aligned with her long-term vision rather than being forced into transactions by market conditions or investor demands.

Action for today: Write down your ideal outcome for your business in 5-10 years. Be specific – not just “grow” or “succeed” but what exact form that success takes. Who owns the company? How large is it? What measurable impact has it made?

Then work backward to determine what decisions today will best position you for that outcome.

What’s your product endgame? Tap that reply arrow and share your BHAG — I’d love to hear where you’re steering your ship.

Or reach out to my team of product marketing consultants at Graphos Product.