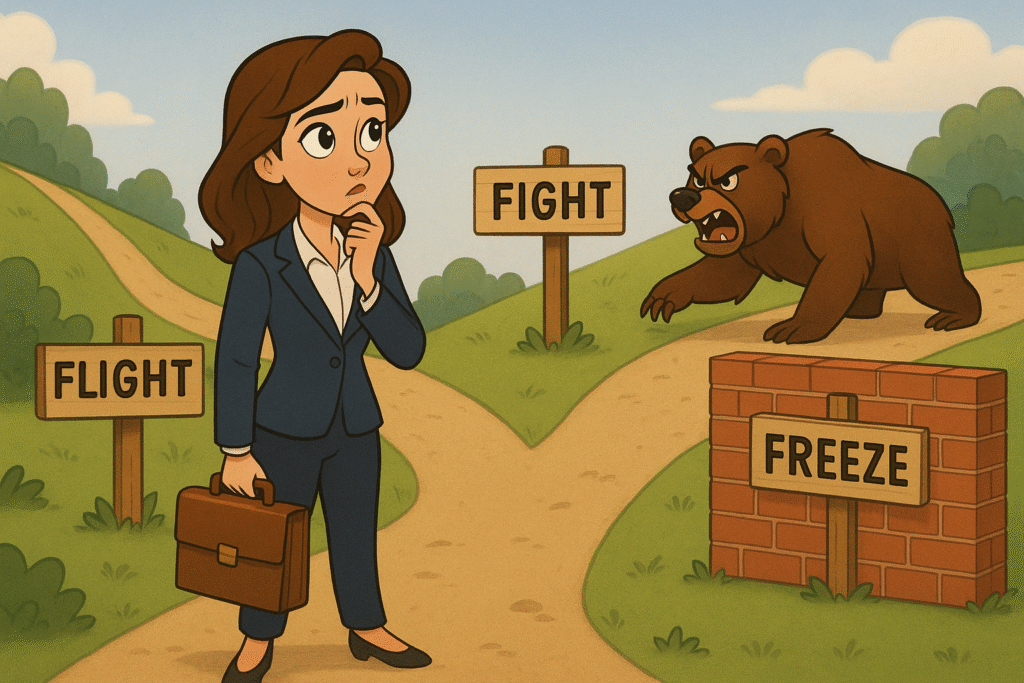

When threats appear, our dog brain takes command.

This emotional, instinctual part of our psychology — which I dig into extensively in I Need That — doesn’t carefully weigh options or spontaneously construct decision matrices.

It triggers one of three immediate, hardwired responses:

Fight.

Flight.

Or Freeze.

In the book, I talk about these primal responses on the BUYER side.

But they are absolutely not limited to the the folks you’re selling to.

They govern product decisions you and I make during market disruption.

The global trade war is creating an uncertainty tsunami — rewiring supply chains, reshoring industries, and flipping stable business models upside down.

While AI companies are drinking from a firehose of investment, most industries face wild new volatility and contraction.

When faced with existential threat, even sophisticated companies default to dog brain reactions rather than engaging their deliberative tank brain.

Your product now stands at this evolutionary crossroads, with three possible paths:

Option 1: Fight This means innovating, adapting, and changing to win in the new reality. Fighter companies see disruption as opportunity. They redesign supply chains, reimagine manufacturing, or pivot to adjacent markets where their core competencies create advantage.

The fight response means charging into change rather than resisting it. It requires investment when others are cutting back, bold moves when others are retreating, and the courage to reinvent yourself before circumstances force your hand.

Option 2: Flight Sometimes, strategic retreat is the wisest path. Flight means exit, sell, or pivot away if the cost of fighting exceeds the potential reward. This isn’t always surrender. Ideally it’s a calculated reallocation of resources toward more promising opportunities.

Flight-centric companies make clear-eyed assessments about which battles they can win. They don’t throw good money after bad (the old sunk cost fallacy) or maintain outdated strategies out of pride. They’re willing to walk away from once-profitable products or markets when the fundamentals have permanently shifted.

Option 3: Freeze This instinct — hoping to ride out the storm by staying perfectly still — feels safe but proves deadly in business environments. Markets don’t return to previous states. Technology doesn’t move backward. Consumer expectations DO NOT revert.

Companies that freeze (think Blockbuster or Kodak) find themselves irrelevant when the dust settles. Their competitors have either adapted or exited, leaving frozen companies with outdated offerings in transformed markets.

The key to surviving market turbulence is engaging your product organization’s tank brain — the strategic, analytical part capable of overriding emotional attachments to historical investments and familiar patterns.

Product Payoff: Electronics retail giant Best Buy faced extinction when e-commerce threatened brick-and-mortar electronics retail. Rather than freezing (continuing business as usual) or fleeing (shuttering stores), they fought by completely reinventing their model.

Best Buy transformed stores into bright hands-on showrooms with price-matching, created the Geek Squad for services Amazon couldn’t replicate, and embraced becoming a physical showcase for online competitors’ products. This counterintuitive fight response increased their market value while competitors like Circuit City and RadioShack imploded. Best Buy recognized the existential threat early and chose to fight on terms where they could win.

Action for today: Conduct an honest assessment of your product portfolio through the fight-flight-freeze framework.

For each offering, ask:

Given market disruptions, should we fight (invest and innovate), flee (sunset or sell), or are we unconsciously freezing (maintaining status quo despite fundamental market shifts)?

Create explicit criteria for these decisions rather than defaulting to dog brain attachments to sunk costs or familiar patterns.

Is your organization fighting, fleeing, or freezing in response to current market disruptions?

Poke that reply arrow and share which response you’re seeing — and whether it’s the right one.

Or reach out to my brilliant team of product marketing consultants at Graphos Product.